This is a guest post by Ellen O’Neill, College Kids Coordinator

If you ask anyone familiar with a Children’s Savings Account program what we can do with $50, the answer may surprise you. Children’s Savings Accounts (CSAs) aim to boost the savings among low- and moderate-income families and help them prepare for higher education. To help grow the account and cultivate a college-saver identity, accounts are often seeded with an initial deposit and grow over time with family contributions and savings matches.

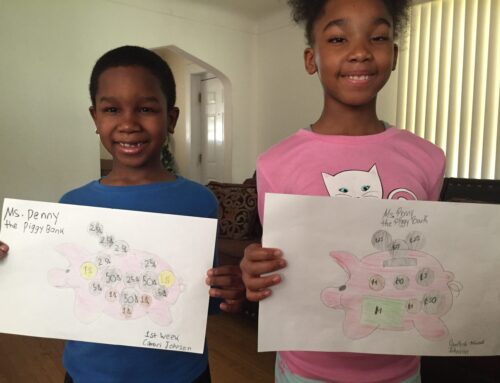

In 2015, the City of St. Louis Treasurer’s Office started our own CSA program called College Kids. College Kids opens a savings account for every kindergartner in the City of St. Louis public and charter schools. Once the account is open, the Treasurer’s Office deposits the first $50. We’re proud to say that, three years in to our program, we have 10,000 accounts open with over $700,000 saved. We are getting ready to begin the program’s fourth year and expect to enroll an additional 3,000 children.

You may ask, “Why start with $50? $50 is a drop in the bucket towards paying for college!” My answer: not necessarily. Research shows that students with any amount up to $500 saved for college are three times more likely to go to college than their peers with no college savings. We also know that these same students are four times more likely to graduate than those without savings.[i] The simple act of giving a kindergartner $50 to save for college triples the likelihood that she will one-day attend college and quadruples her likelihood of graduation.

Research also tells us that students provided with a CSA early in life score better on socio-emotional indicators than their peers who did not receive a CSA. This means that, among other behaviors, students with a CSA are more likely to be better at building and maintaining relationships with their peers and managing stress.[ii]

We also know that the most disadvantaged students gained the most from social-emotional benefits associated with CSAs. Effects of having a CSA were particularly strong for children whose moms have low education level, low-incomes, received welfare benefits, or rent their homes.[iii] According to the 2016 U.S. Census, approximately 24 percent of families residing in St. Louis live at or below the federal poverty line (double that of the overall United States). Therefore, we know that students in the City of St. Louis, a fourth of whom live at or below the federal poverty line, have the most to gain from a $50 savings deposit.

Finally, we know that starting students saving early works. Kids as young as five years old begin to recognize that goals of savings accounts and can develop a preference for saving over spending. Opening a College Kid account gives kids early opportunities with money and saving that has a noticeable impact on adult saving behavior. [iv]

Our initial $50 deposit to a College Kids account represents so much more than the account balance. That $50 deposit triples the likelihood that the student will go to college. It helps children understand the importance of saving for the future. It helps families to take the first step towards helping their child achieve great things one day.

[i] Center of Assets, Education & Inclusion 2013

[ii] Joseph A. Durlak, Roger P. Weissberg, Allison B. Dynicki, Rebecca D. taylor and Kriston B. Schellinger, “The Impact of Enhancing Student’s Social and Emorional learning: A Meta-Analysis of School-Based Universal Interventions,” Child Development 82, no. 1 (2011): 475-501

[iii] Jin Huang, Youngmi Kim and Margaret Clancy, “Material Hardship and Children’s Social-Emotional Development: testing Buffering Effects of Child development Accounts in a Randomized Experiment,” Child Care, Health, and Development (2016)

[iv] Terri Friedline, “A Developmental Perspective on Children’s Economic Agency,” The Journal of Consumer Affairs 49, no 1 (2015): 39-68