When your W-2 comes in the mail, you know what that means. Tax time! Time to file taxes and plan for any returned income.

If you need some tax help, here are some suggestions to get you started:

1. Get free help with your taxes. If your income is $65,000 or less, visit naba-stl.org/vita/location for locations, dates, and times.

2. Do it yourself online. If your income is $66,000 or less, you may be able to file your own taxes. Visit www.MyFreeTaxes.com for more information.

3. You could win a cash prize if you participate in one of the above programs and save part of your refund. More info at SaveYourRefund.com.

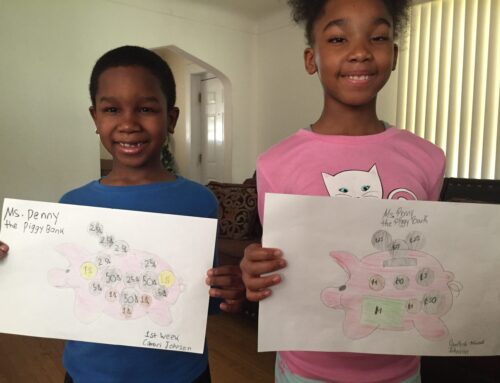

4. Get money for your kid’s college. Every K-3 student in a St. Louis Public and charter school receives a savings account from the Treasurer’s Office with a $50 deposit. Families can watch the account grow through efforts and incentives such as matched savings, attendance bonuses, and parent participation in financial education courses. Visit stlofe.org/college-kids.

We hope this helped. And remember: you can call the national 2-1-1 hotline for more assistance!

Disclaimer: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.