(This is a guest post by Patrick Hain, Principal Associate, National League of Cities)

In 2017, 486,000 people claimed the Earned Income Tax Credit (EITC) in Missouri – which provided them on average an additional $2,456.[i]

If you’re like me, your tax refund is the largest check you’ll receive all year, and it offers an opportunity to pay down debt, make an investment in your children or purchase something that will improve your household like a new fridge.

Like St. Louis, cities across the country are working hard to make sure that their residents are aware of tax credits like the EITC and that they file their taxes using a certified tax preparer. In St. Louis, there are several partners that provide Volunteer Income Tax Assistance (VITA) programming that will help you keep more of your refund.

On average going to VITA saves you an additional $176 in fees.[ii] That’s more money that we all could use.

The VITA tax preparers also help their clients understand and claim eligible tax credits from the EITC to the Child Tax Credit (CTC). Additionally, VITA programs have an industry high accuracy rate of over 90 percent.[iii]

Before you start thinking about what you’ll pay off or purchase for your home, make sure you pay yourself and let your refund provide additional financial security for you and your family.

You can start by taking the St. Louis Saves Pledge.

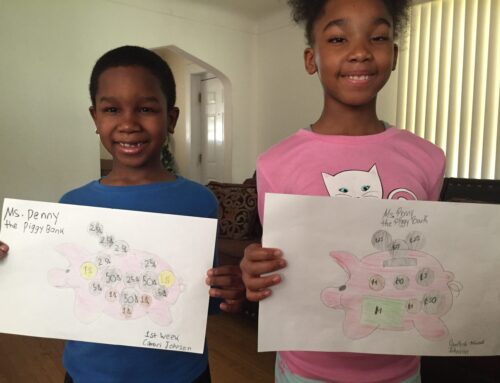

The pledge helps you reach your savings and debt reduction goals by stating what you’re saving for and how much you’ll be saving. The pledge could be putting 10 percent of your refund into your child’s College Kids Children’s Savings Account or your own savings account.

Before heading over to a VITA site, remember to bring along the key information that they’ll need to file your taxes – including proof of identification, bank account routing and account numbers for direct deposit, your W-2s and your child’s College Kids Children’s Savings Account information.

I would suggest that you call ahead and schedule an appointment with the VITA providers and verify what additional documentation you might need to provide.

Tax time offers a fresh start to pay down bills or invest in your family’s future. Either way, you’re increasing the financial stability of your family, your community and your city just by filling your taxes.

[i] https://www.eitc.irs.gov/eitc-central/statistics-for-tax-returns-with-eitc/statistics-for-tax-returns-with-eitc

[ii] https://connect.nsacct.org/blogs/nsa-blogger/2017/01/27/nsa-survey-reveals-fee-and-expense-data-for-tax-accounting-firms-in-2016-and-2017-projections

[iii] https://prosperitynow.org/files/resources/SOAP_State_VITA_Support_1-19.pdf